POPULIST PROPOSALS UNVEILED …

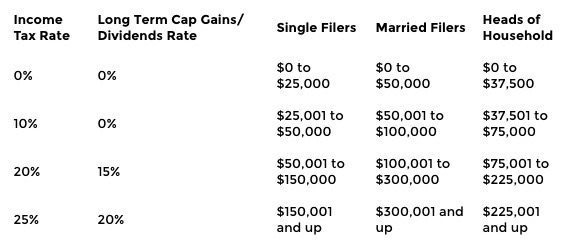

|| By FITSNEWS || Confirming his prior statements, GOP presidential frontrunner Donald Trump rolled out a populist tax plan this week that he said would take “nearly 50 percent of current filers off the income tax rolls entirely” while “reducing the number of tax brackets from seven to four for everyone else.”

Trump’s plan – which his campaign stated was “revenue neutral” – would reportedly eliminate the income tax for 73 million American households (those making $50,000 or less). Another 42 million households currently filling out complex tax forms only to determine they owe no taxes “will now file a one page form saving them time, stress, uncertainty and an average of $110 in preparation costs.”

The new four-bracket tax code would eliminate the marriage penalty, the alternative minimum tax and provide individual filers with “the lowest tax rate since before World War II.”

Courtesy of his website, here’s a look at Trump’s flattening of the tax code …

“These lower rates will provide a tremendous stimulus for the economy – significant GDP growth, a huge number of new jobs and an increase in after-tax wages for workers,” Trump said.

In addition to the new tax brackets, Trump also wants to eliminate the death tax and impose a flat fifteen percent tax rate on all business income.

“This lower tax rate cannot be for big business alone; it needs to help the small businesses that are the true engine of our economy,” Trump said. “Right now, freelancers, sole proprietors, unincorporated small businesses and pass-through entities are taxed at the high personal income tax rates. This treatment stifles small business.”

That’s for sure …

So … who pays the freight for Trump’s tax cuts? According to him, his wealthy buddies.

Specifically, Trump’s plan calls for the reduction or elimination of “most deductions and loopholes available to the very rich.” It also calls for the reduction or elimination of “corporate loopholes that cater to special interests, as well as deductions made unnecessary or redundant by the new lower tax rate on corporations and business income.”

Obviously this website has never seen the value of revenue neutrality. We believe economic expansion is best achieved by tax cuts, not tax swaps. Having said that, if Trump is serious about targeting his relief to the middle class and letting wealthy one-percenters pay the freight … well, we’re not going to argue with that.

We’ll have to do some further digging on Trump’s proposals, but at first glance they certainly seem geared toward changing the current structure in such a manner as to empower the individual consumer – while extending lower tax rates on business income to sole proprietors and other small businesses.

Those are good things.

Now … do we agree certain Americans should pay no tax whatsoever? No, we do not. We believe a truly fair tax plan requires all Americans – even those at the lower end of the income spectrum – to chip in something.

Anyway … we encourage you to do some digging on Trump’s tax plan, too. And let us know your thoughts as you do.

111 comments

Liberal-Tarians have lost Boehner. McConnel may be next, and Jeb, Lindsay and Hillary are in the Crapper…

Is this FITSNews conceding that they think Trump gives them the best chance to cling to power,and continue using our money to feed their greed?

Trump better hope the FITSNews types are not on his side. It’s the kiss of death after what Obama has done to our nation.

That said: FITSNews boringly regurgitating what we already know, is worthless. But what it says about the left’s strategy (or position) for those of us who can read them, is invaluable.

Trump won’t be the nominee.Rubio or Cruz (Rubio a better chance) with Trump Fiorina and Carson long shots.

What Trump has done is get rid of Bush and Boehner while assuring that there won’t be amnesty or a path to citizenship for decades.

Democrats are finished.Obama destroyed the party and Trump just buried it.

Too bad you guys are all the same person. Trump might have a chance if all your profiles coukd actually vote, flip/pogo/BigT/nchuckler/douche

Already giving up on your god Trump, flip?

Trump already won.No Bush.Boehner gone.Wall and NO amnesty/path to citizenship!

Wait? Is this winnning like you claimed during the mid-terms? You might want to hold off on claiming victory this time, dummy.

Leave him alone.

It’s going to be great when Flip tries to walk back his dissing of me after Trump betrays the party and I end up nominated anyways.

That was faster than I thought it would be. Who’s next ?

I am beginning to think that Trump will not be the nominee. He is down to low 20’s in most polls. We will see what this does for his numbers, I suspect a boost, but long term, I am not sold on yet.

Rubio looks like he could be the solid candidate that could garner support in the minority community.

Told you so.

Yes indeed.Good read.Rubio made a mistake on immigration by being part of the Gang of 8 as a young senator but learned his lesson.

Rubio would make a great President.

Si, perfecto!

Trump will drop out and run third party, of course he won’t be the nominee. He is going to sabotage the Republican party. We all know this, only dumbasses like you don’t see it yet.

Na.No third party OR sabotage.Smart business man.He got in to get rid of Bush and to shape immigration policy as a great American. He understands that illegal immigration destroys our economy,has negative consequences on trade, increases crime and allows terrorists into the country.

Job well done Donald.

I’m dumber than owl shit, but that’s easy to see.

“He understands that illegal immigration destroys our economy”

Ready to mow some lawns and scrub some toilets instead of collecting your benefits today?

Get you dead beats off of welfare and we won’t miss the illegals one bit.

Ok Kettle.

Maybe you and Zombie Tango can scrub each others balls. Like your avatar.

But we’ll still be stuck with you and flip.

At least immigrant contribute to the economy.

Just like Hillary was GUARANTEED the NEXT POTUS. I guess you have to cling to some hope after totally fucking up the country.

lol…they sure are desperate…clinging to a 3rd party run as they know they don’t have a candidate that can win…

You don’t even have a freakin’ party!!!!

LMAO!!! That from an American hating socialist from the Democrat Socialist Party. Go Bernie!!!

No seriously. You control Congress, how’s your Speaker doin? You’re sure to win the White House – who’s leading your nomination race? Control the Senate – what you callin’ the guy in charge over there?

She’s a lying sack. We’ll use Joe – the beloved VP of the US. And you’ll have crap.

You are very accurate I think, except we may disagree on who the final nominee will likely be.

But whoever it is…we’ll get out of this disaster. Boehner surrendering was the FIRST big sign that their hose is crumbling.

You sir are a GREAT AMERICAN!!! I told ‘Willie’ Cunningham on WLW 700 about you the other day.I bragged about how much of difference ONE person can make in America.

You are that example. That is why the 8 (?)regular contributors on Fits boycotted SCPD.Liberals want to silence the truth.

I did not really care that they boycotted, if they did. The few made no difference. I got feedback, especially from liberals, from all over the country. They had never been talked to with the authority and command I imposed on them. Provoking them was my intent, and it was a wild success.

Stopping it was a time and priority matter w/ me. I manage other websites, and SCPD outperformed many.

People in SC are hungry for it. Once I get some other things lined up, I may ramp SCPD back up. It was a lot of fun. But good writing, and Liberal attacking can be draining. It was a responsibility.

And some of the best traffic I got was defining FITSNews, and the lemming dolts who follow it. That was very personally rewarding because I did it so well, and pissed them off so much.

“They had never been talked to with the authority and command I imposed on them.”

lol fuck that’s funny!!!!!

I think you are proving his purpose, as he stated it above.

Talk about yourself much?

Sir you drove em insane with hate.The articles were fantastic and VERY accurate.

Fits is infected with American hating liberal perverts HOWEVER that makes it fun for the 4 or 5 of us that are spiritually driven and intellectually factual 100% of the time.

Very well said. You GET IT…and you are a true Kindred Spirit. Thanks.

It helps to know you are out there. You are rare and valuable, especially with the level of ignorance, hate and failure being perpetuated by the Democrat Party.

Onward and Upward (Those MoFos HATE it when I apply their Bullshit saying, and kick their asses with them)…

I notice that you have conveniently not reported Trump’s endorsement of socialized medicine last night.

“We’re going to have privatization,” Trump continued. “It’s going to end up being absolutely great.”

When asked if his plan is the cure for Obamacare, Trump said he doesn’t want to fix Obamacare.

“We’re going to get rid of Obamacare,” Trump told Breitbart News

Oh.

Well this should keep it going for a while longer.

I wonder if even Trump is like “How long are these idiots going to fall for this?”

CAPTION FOR ACCOMPANYING PHOTO FOR THIS ARTICLE:

Anderson Cooper asks The Donald “How big is your penis?” . . . .

My guess is not as big as yours.The one in your mouth.

You say that with longing in your voice.

As always, pogo is just jealous of other people who comment here.

SLED ever get with about the tailor,pervert.

FITS, last night on his extended interview with 60 Minutes, he said his tax plan would take in the same “or more”. He elaborated that he was going to ramp up military spending, and go fight ISIS. Add in his inherited, and personal career long crony capitalism ventures, it is implausible that you can support this windbag.

“Some people that are getting unfair deductions are going to be raised.

But overall, it’s going to be a tremendous incentive to grow the economy

and we’re going to take in the same or more money. And I think we’re

going to have something that’s going to be spectacular.”

http://thehill.com/blogs/ballot-box/presidential-races/255097-trump-im-a-pretty-good-republican

I watched him on 60 Minutes and kept thinking the whole time he lives in a fantasy world. All his big plans would probably triple our current debt. His BS that it will cost nothing because we the people and the country will be rich, is like my day dreaming that I won the lottery.

“Now … do we agree certain Americans should pay no tax whatsoever? No, we do not. We believe a truly fair tax plan requires all Americans – even those at the lower end of the income spectrum – to chip in something.”

Only way you are going to get free loading Democrat Socialists to pay ‘something’ are user fees.They pay ZERO state or federal income tax however they enjoy all the FREE services the taxpayers provide-Section 8 housing,Food Stamps,Medicaid etc…

They can contribute a few penny’s for their freebies.

One thing for sure. This plan keeps Tango from having to pay taxes.

Tango pays for your NON citizen mother in-laws Obamacare subsidy so you don’t have to work and can play on Fits all day.

You should thank him.

To bad all those profiles of yours can pay taxes. You sure are keen on identity fraud…..makes you wonder how shady and unethical you must be IRL.

Why don’t you come on over and find out how I am IRL? Pussy.

Beating up the elderly ain’t my thing. Unless it’s here and it’s you. I’ll verbally slap the shit out of you any and everyday.

If you were me you’d slap the piss out of him instead, then eat his brains.

I’m so much cooler on line.

I went in a white trash home once before and the smell was horrible, and they were not nearly as unhinged as you. Your smell could probably strip the paint off walls.

I pay for that. I built that. He built a blog that failed. Shouldn’t you be driving to St. Augustine for the early bird special?

Another week.Obamacare subsidies are provided by ALL of us.

Bad news dude. They ain’t got them fried fish houses there anymore there. And the streets is filled with people speakin’ Espanoley.

Dude I spend more time in St.Augustine than you ever will.Don’t you ever get tired of lying about who you are?

Just tellin’ ya – speaking lots of that Espanoley there. Used to live in NE FL.

Try Casa Maya – Hypolita Street. Really good.

There used to be a great little place called the Coquina Café right across the street from the Castillo de San Marcos.

Was there in July – in the town. I think it’s still there. Mexican place. Flip would never go there – they have – uugghh – Mexicans.

Interesting. It wasn’t Mexican back in the day. Burgers & sandwiches. That was a long time ago though.

I always picture flip as Morty Seinfeld.

No. Uncle Leo

How about Mr. Castanza. BTW I look like George.

This shit is easy.

1.mamatiger92 is Kathy Bates from Misery

2.Rocky Verdad is an American hating liar and tax cheat…. a combination of Benedict Arnold and Bernie Madolf

3.Bible Thumper is a combination of ‘Fast Freddy’ from the Gomer Pyle Show and Columbo.Slick but plays dumb.

Please, pick more recent sit coms. Mamatiger is actually Jay from Modern Family. Bible Thumper is Kramer. Sandi Morals is Elaine. Tango is that fat queer married to Mitchell in Modern Family. I sir, am Maney.

See, that is your problem.Too much tv time dad.

You know who throws those Modern Family re-runs on? The kids. They insist we all sit together and watch Modern Family for like 90 minutes on Friday nights. We just can’t point out Mom sounds like Gloria. (And is cute like Gloria too)

lol…Rocky I give you credit.Whoever writes your lines on Fits is pretty damn good.

When they’re on time.

Actually, Kim Davis is closer to me.

Anyone else. Who wants to venture up what Flip looks like based on a sitcom. I think his wife looks like Gloria on Modern Family.

Jack Clompus?

Crazy Devola.

I always pictured you as the typical ugly,snaggled tooth,smelly ,abortion loving dog that the Democrat Party produces and goes grey at 30.

Come on Flip – we’re having a light moment. I just gave the Mrs. a huge compliment.

I was as well.

Tango wasn’t paying taxes before, at least not federal taxes. Neither was Flip. Those guys are takers, not makers.

Oddly, at first blush, it’s not that bad of a plan. The biggest cuts are actually at corporate taxes which are a smaller portion of overall tax revenues. Still think it’s not revenue neutral – probably a $200 billion donought hole to the deficit. But otherwise, oddly, isn’t complete crap. Which is what you’de expect from Donald.

Wait until the GOP hears about this ‘plan’. They’ll straighten him out.

Oh, and I love where you can pay no tax, but you have to file a form that says “I Win” – and you get a free hat made in China.

This is a tax plan progressives could actually get behind. I like it.

yeah,sure

So, why is Trey Gowdy in to the foto?

Do you mean Anderson “Put in my my pooper” Cooper?

That’s Trump showing Anderson some love.

Is he showing us he washed his hands after stroking him off?

Sick. “Love that Cooper kid. Great kid. Great kids. A little light in the loafers, but great kid. Knew his Mom. Wonderful lady, Wonderful”

Oh, oh that…well you know, Trump loves the children too.

Unlike you, I did “dig into” Dump’s tax plan. It’s a giveaway for the wealthy disguised as an aid to everyone else. Don’t bother doing any homework yourself, just keep on braying about how wonderful is everything Libertarian-shit.

Dan I can’t figure out why you are STILL so angry after the gay marriage ruling. That was all you talked about.

STFU…if the wealthy did not pay exorbitantly, lazy ass-sitters – like you – would starve.

I was talking w/ a beggar I gave $10 bucks to, Friday. He aid he HATES Obama because the handouts are so paltry. He said when Bush was president he had a pocket full of money.

He said the Obama people paid more for Homeless votes…but he said fick that, it’s not worth 8 years of Obama’s misery to score a couple packs of cigs and a bottle of ripple.

Well if you are in misery now 2016 will be total devastation. LOL !

My go-to site for economic issues: http://economistsview.typepad.com/economistsview/2015/09/trump-plan-is-tax-cut-for-the-rich-even-hedge-fund-managers.html

Flips go to site for news – Breitbart.com

Trump’s paying Breitbart for positive coverage.

I bet Will wishes he could get a check or two of Trump Sr’s fortune.

My Go-To post to see what an ignorant fuck thinks, is http://Tom's-Licker.com

You’re about the Dumbest Fuck on here. So I doubt that website wants you making them look like stupid shits, by referencing them.

TANGO! I’ve told you to stop badgering the other students! You are failing this class, you cannot afford to be pestering others when you need to study! Do you want to go to the principal’s office?

If you have to live just for your juxtaposition to me, or the other creatives, what kind of existence is that?

He is the newest ‘speedo’ wearing Maxwell Smart-investigating bloggers as the self -proclaimed Disqus douche bag and like Boz alleging the whole neighborhood is occupied by felons with envelopes of cash hidden in tin cans and buried in every legislators backyard.

Seem to be in an extra special mood today…welfare check arrive?

No welfare checks for me.Just high on LIFE and the fact God is SO good.

Can’t be that high, since you have no life as we know it !

Fuck you failed Marine.You are a disgrace to this country and my guess is your weakness as a soldier was one of the reasons we lost all those Marines in Beruit.

Now that’s funny…and TRUE…

No mention whatsoever of a flat or national sales tax (the one the “Baggers” label “fair tax”)===nothing more than a variation of the same old fucking theme that damn near every other Republican touts

Fuck that do nothing cowardly sack of draft dodging shit

Trump’s original ideas my hillbilly ass!!!!!

“We believe economic expansion is best achieved by tax cuts, not tax swaps”

Bring on da voodoo. Bring on da noise.

“We believe a truly fair tax plan requires all Americans – even those at the lower end of the income spectrum – to chip in something”

They do chip in something. It’s called Medicare and OASDI tax. Convenient, as always, that you left out the word “income” when you talk about Americans who pay no tax

He eliminates the estate tax and that benefits ONLY people who have an estate worth more than $5 million, i.e., the very rich…and, of course, his wives and children.

Trump for Prez !