|| By FITSNEWS || U.S. consumers reported spending $87 per day in March (excluding mortgages, car payments and monthly bills) … up $4 a day from February but roughly identical to last March, according to data from Gallup.

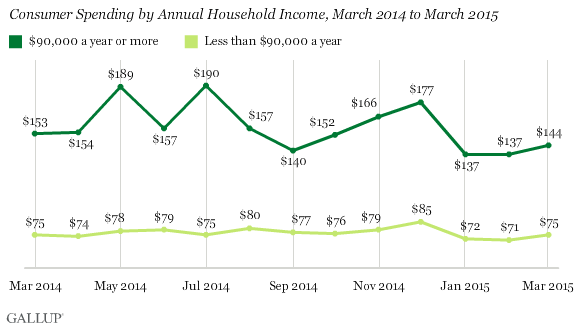

Those making more than $90,000 per year reported spending $144 per day – up from $137 in February (but down from $153 last March). Meanwhile those making less than $90,000 per year spent $74 per day – up from $71 last month (but identical to last March).

What to make of the numbers? Eh …

“The broad trend shows spending recovering after reaching lows during the Great Recession and its aftermath, but for the first months of 2015, spending has been lower than it was for most months last year,” reported Gallup’s Rebecca Riffkin.

In other words the consumer renaissance we were promised in 2015 has yet to materialize … as we predicted.

Courtesy of Gallup, here’s what the self-reported daily spending trend lines look like over the past few years …

And here’s what the last year of self-reported spending data looks like broken down by income group …

42 comments

I know I’m spending less. A great deal less – on gas prices – ha, ha, ha, ha!!!!!!! And milk is down in price too!!! Oh yeah baby!!!!

Groceries are waaaay to high. I have family on fixed incomes, retirement age, their healthcare is less, cost of basic necessities more. Explain that? Inflation.

I have a family of four – and we’re fortunate – income wise. But I don’t see the increases in food prices like I did say 7 or 8 years ago when milk was $4.35 a gallon, etc. Of course we go through a lot of milk – so I see that. Seasonally I see stuff fluxuate – beef goes up silly sometimes, then retreates. Pork sometimes, chicken sometimes. But then again we don’t eat much pork, shop sales, eat a lot of veggies (which are always higher if fresh anyway) – so maybe we’re just used to it. But in fruits and veggies (outside of pineapple) – seems the imports are able to keep prices pretty stable. Personally, I think it’s a sin against God to charge more than $1.25 a pineapple – but hopefully Cuba will help us out there.

Rocky, your last comment is hilarious! So I will focus on that first and repost “Personally, I think it’s a sin against God to charge more than $1.25 a pineapple – but hopefully Cuba will help us out there.”

I don’t disagree with last 7-8 years, but….under current administration, food prices have soared, while programs are cut. It is hard to blame any one person, I am probably more inclined to look at the Federal Reserve and the excessive printing of money. Then I do and think “what if….” If I follow the what if’s out far enough and factor in events, I think the best decisions were made given the time in history.

I disagree with Obama on policy, and I do wonder if the numbers are getting better, the closer we get to election. The next 4 years are more indicative of what he has done to the economy than the past 4 IMHO. That goes for every POTUS past and present.

Many come in looking strong and go out looking weak, while the reverse can also be said. There are decisions made for us every day, that we have no clue about. Everything from printing money to national security.

I still believe in America the land of freedom, but I am becoming more of a skeptic than in the past. I am also becoming better educated about world affairs/politics. I guess the two go hand in hand.

America is still strong, the people just need to bond. We don’t need the government to make that happen – we get the government we deserve.

Yeah, but when you look at the CPI ratings for in-home food year over year, published by the USDA, it’s usually under 3%. Now that’s higher than inflation – i.e. inflation running around 2% these days, but it’s not huge. I do agree some food items have increased. But others fluxuate. Like I said, I can remember milk at $4.35, now it’s $3,87. Disruptions affect them, that’s why they are volitale. Clinton limped out of office, I don’t think Obama will. You can disagree with his policies, but the man has never really played it safe. I suspect he has an idea of what he thinks is good for the country (particularly in foreign policy) and will pursue that. Now, I want those cheap cuban pineapples.

Not to burst your bubble Rocky, but I remember milk at 99 cents a gallon, maybe 20 years ago?

I don’t disagree he has an idea of what is good for the country, I do disagree with how he achieves that and the cost.

Now I want some of those cheap cuban pineapples too! LOL. Hey – see that plant next to my pic. No kidding, I grew that in SC, that was a pineapple bud. Best Pineapple I ever had – yes, had to keep it inside in the winter, but beautiful plant.

Oh cool. I’ll give it a try – Low Country weather might make it work.

Precisely, year over year spending would be up if gas was excluded.

Gas prices affect everything. The unfortunate thing is, once retailers/grocery stores have an excuse to raise prices, they are not going to lower them unless competition (supply/demand) commands it. It is supposed to be against federal law to price fix, yet – are they? I dunno, but if gas prices are down, how can grocers still command a higher price. Corn, I understand, but the prices for groceries are probably 4x++++, based on general observation, v. 8 years ago.

California Drought is not helping. Less supply; Higher prices.

Don’t know much about the CA drought without Googling it, but less supply means higher prices. It’s like Ocean front property – many want it, therefore the price is higher, until it isn’t.

Not being a pain, but it’s demand that sets prices, generallys peaking, not supply. Unless there’s inelisticity. So possibly in the case of ocean front property – since there’s no real substitute, but many other items are elastic.

In free markets it would be supply and demand, but if they slow down production (supply) them yes, it is going to raise prices based on demand. I wonder what would happen to food prices if all the farmers actually farmed?

If there are three grocery stores and three gas stations in your small town, then you have the best of both worlds, the fat and the lean.

There are economic theories that consider “the three restaurant question” of supply and demand, quality verses costs, etc. It can be demonstrated that if a small town has only one restaurant, then it won’t do very well. If there are two, then both will “just make it”. But if there are three restaurants in that small town, well, they all do very well indeed, because the locals believe that that small town must be a good place to eat! (Examples: Occidental Ca. (pop: 800, 4 big restaurants) verses Bloomfield Ca. (pop: 900, 1 restaurant) … and Bloomfield is on a major highway!)

It would seem that 90k/year is a rather arbitrary number. The median household income ranges (depending on the state) between the 35k and 70k–roughly.

Since the middle class really does drive the economy, wouldn’t it be wiser to look at a number less than 90k?

EDIT: Since the middle class SHOULD be the driving force

LOL – I love Cherith’s reply on that link:

“I will let someone make me the fall guy for everything bad that happens in their company for like $10 million. And, I mean, you can really humiliate me. Stockades, throw rotten fruit, personally call the stockholders while crying, whatever you want. Go to town.

And I’ll take credit for all of the good things like a motherfucking pro, too.”

I know, right?

Anyone in SC who needs to spend $74 a day is SOL. The average median income will not support that kind of spending here, where cost of living is less, while inflation is still high.

Anyone spending $74 a day probably is over spending and not saving.(again that number excludes mortgage, car, bills)

I agree, it is over spending – gross overspending.

That’s the trouble with those out of state polls. If the pollster is in New York, then they can’t possibly understand how someone can possibly survive on less than $75 per day.

When I take into account my house payment, car + home insurance, taxes on both, maintenance on everything, gas for everything, food, electric, water, and every other bill I have…I’m probably spending about twice that much.

The article factors out some of those costs.

The jobs data is bad, but as soon as we cycle thru the gas price drop, year over year consumer spending data will look better hopefully.

I remember Fits quoting someone that said savings do not drive consumer spending but rising incomes do. Failing gas prices can hurt consumer spending because gas sales are included in consumer spending. If a portion of those savings are actually saved and not spent on something else then consumer spending falls. But it is good that people are saving, because that could unleash higher ticket sales later.

Only if retailers/wholesalers adjust price for gas. They are quick to raise but VERY slow to fall.

Unfortunately, I agree with FITS to a degree – savings does not drive consumer spending, but a “perceived” increase income will. Notice I said, perceived. Is it really an increase in income when prices have risen everywhere? How ’bout that housing market? Look at the companies who scooped up all the low/middle income properties so they could rent or sell back at a higher price. Don’t blame them, but it will be a good while that families can afford a middle/low income house unless they can find one in foreclosure.

Those falling gas prices that you include with consumer spending, are not decreasing the prices that I have noticed, so therefore they do not currently equate to savings. People in SC are barely getting by.

Most people aren’t saving, they can’t afford to. Some are hoarding, but they aren’t saving and few are spending. Spending/consumer confidence (which is the same in my mind) is what drives the economy IMHO.

Part of the reason I am considering South Carolina for a retirement home is that the costs of everything is lower than the Big City States.

In areas where incomes are “low”, and housing construction is dormant or close to it, is an attraction for those of us fleeing the high tax, high cost states.

Come on down ;)

good chance sometime this summer.

Any idea what part of the state you are going to visit? Upstate, Midlands or Coast?

All of it. I want to get a fishing boat.

I have relatives in Atlanta, so will probably make an extensive examination of the area.

I have lake front property, with a dock and boat for sell, hop skip and a jump from Atlanta, well a few hours maybe ;)

Nope … Atlantic access required from a marina … I’m serious about deep sea fishing and Intercoastal excursions.

How does that tech business play into that? ;)

Can’t say. Blowing up the crucible at this point would kill that business potential.

The largest expense most couples incur is housing, so according to Gallup Poll “excluding mortgages, car payments and monthly bills” Consumers are still spending and average of $74 per day on “other things.”

Hey, in SC, that would be a truly great day! Consumer confidence would rise, IMHO, but the average in SC isn’t average at all.

Let me see if I can find a reputable link – last I checked was years ago and the average median income per household of 4 was roughly 40-45k and that included all the exclusions.

Times change quickly, so before I need someone to remove my foot from mouth, let’s look at SC our primary concern.

Here is what I find at a quick glance, which is inline with past numbers:

$23,943 – Annual personal income per capita (2013 – ranked 42nd in US)

$44,779 – Median household income (2013)

http://www.sciway.net/facts/

The $74 per day is roughly 27,000 in what I call discretionary spending based on the Gallup Poll “excluding mortgages, car payments and monthly bills”

People in CA or NY might spend and average of $74 per day, but not in SC, not on your best day – on average.

Those polls that exclude “mortgages, car payments and monthly bills” … Substitute the word rents for mortgages … See what I mean?

“Rents” is a real killer for the poor and missile classes. Paying rent is also paying not only your own taxes, but most of those of the landlords as well.

The largest single expense most couples make is taxes. Taxes are half of fuel costs, more than a quarter of housing costs, more than a quarter of clothing costs. … and if a couple is above that $90k annual threshold, then taxes are an even bigger bite of their income.

For “some” yes, but not most. Not in SC. I think that is why they feel entitled to our hard earned tax dollars. Hell, the State isn’t giving it to them and they deserve it, it must be our job?

That is sarcasm, but the truth is the state is fighting the federal government for funds to maintain state sovereignty. SC wages are low. Not a lot a lot here pay taxes that are a 1/4 of housing costs or clothing costs. Higher brackets get raped.

Housing costs: considering the costs of replacement, some of that can be like paying sales taxes twice, paying excessive increases in “value” as “newly assessed”, paying extra income taxes (because of non-deductibility, etc.), sales taxes on construction material and income taxes on labor (their taxes and yours) …

And its not just the higher brackets that are being skewered by the taxsuckers. Even using food stamps to pay some stuff has extra sales taxes on “necessities” … like diapers, toilet paper and fuel and entertainment and … and …

Night FastEddy – Look forward to debates next time ;)