So I was camping in the South Carolina back woods (again) last weekend and found myself sitting around a fire discussing … wait for it … the current status of the American real estate market.

Yeah … I’m kind of a dork.

Anyway, my partner in this particular conversation – a North Carolinian – had recently seen an article in The Charlotte Observer regarding the rise in institutional home buying (I don’t read that rag, but I presume he was referring to this article).

Meanwhile I tossed out some statistics found in this story from Zero Hedge … which concluded that America’s so-called housing “recovery” was merely “the latest speculative play by deep-pocketed investors, who are now engaged in rotating cash gains out of capital markets and into real estate, on their way hoping to flip newly-acquired properties to other wealthy investors.”

Either way the reality is the same: The same bubble which popped in 2008 (with disastrous consequences for the global economy) is getting ready to pop again.

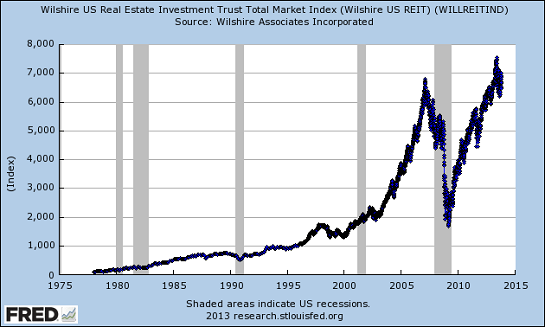

Don’t believe me? Take a look at this chart from the economic blog Of Two Minds … which shows that “real estate valuations are once again at asset-bubble extremes.”

(Click to enlarge)

Yikes …

My website has been adamant in opposing the “everyone has a right to affordable housing myth,” which served as the basis for the government intervention in the housing market which spawned the 2008 collapse. Yet for reasons surpassing understanding the administration of Barack Obama has chosen to go down the same road.

In fact they’re still selling that myth on Capitol Hill … or trying to.

Will Folks (a.k.a. Sic Willie) is the founding editor of FITSNews.com.

33 comments

So is the Lexington Mafia thing completely swept under the carpet as expected?

You F*$#ing no talent idiot. When sellers are losing 30% percent in home values, when they sell…a bubble is not likely. Homeowners are taking a BEATING because the leftwing government (w/ giveaways) devalued the market, and Obama’s economy has been (is) a FREAKIN disaster. Bush warned us about it over and over…and FITS was too stupid, or corrupt, to understand,

The dirty secret is that there is no money in the economy because the D!#% you suck, named Obama, has F#&*ed up the economy. While you sat on your Ignorant @$$ and told us he ain’t so bad.

When the Dumb@$$ Geniuses like FITS try to pass themselves off as authorities, pieces of $#!* like Obama laugh loud and reign supreme.

IOW: When the watchdog is too stupid to know that he is the @$$hole, not the hole in the ground….Theives and liars get off. And all this stupid SOB named FITS does is blame the GOP.

Relax, Will. Everything’s goin’ to be okay…

Where did you come from? Where were you? Recovering from that anal reaming that 9″ gave you?

Is that anything like the Suck-Off you’re rendering to FITS and Obama, you dullard participant in the Army of Dumb@$$#$, who are F*@#king up the country.

So, who is this 9″ they are talking about? Have you been giving that ass to someone besides me?

Slap fight!!!

Not much funnier than two gay guys in a hissy fit.

Ever notice how wide he is? We can share,and maybe feel something..

He loved it so much,I couldn’t get him to leave me alone,and had to get a restraining order…He is extremely passionate,but I do not like,’cuddling’,afterwards.When he demanded that I call him,”Boo”,it was all over…

The only homeowners who are losing 30% are the dumbasses who paid too much for their homes in the first place.

Hey GT, I missed you.

“My website has been adamant in opposing the ‘everyone has a right to affordable housing myth’

Which has jackshit to do with institutional investors flipping hosue.

HOUSES, god damn it.

I always thought you were infallible.

:(

When no one has a job, because of F&*$king idiots like you, FITS and Obama…there is no such thing as AFFORDABLE housing…other than the Section 8s, that you stupid son of a B!&#hes get w/ your Obama-phone and food stamps.

Lighten up Gary, the Lord’s coming back.

Of course she is.

http://www.youtube.com/watch?v=u7T64Qo3bdU

Institutional investors, some of which were recipients of the last round of bailout money(but hidden by shell corps) and most of which are taking advantage of artificially low interest rates-once again driving up the price of housing unsustainably and REDUCING AFFORDABLE HOUSING.(short term)

The circle is complete. You now have reached enlightenment Jesus. Glad I could help.

I’m not sure what real estate valuations this chart is referencing, but I’m pretty sure my house’s valuation is not back to the 2008 levels.

Correct, for the moment.

You’re on it, JC. This is more tin-foil hat stuff. Statistics are dangerous things, as we all know. They are easily manipulated (or misunderstood) by folks not intimately familiar with the subject at hand. The housing numbers are NOT back in the vast majority of markets (even the Wilshire numbers actually indicate that the overal market is back to roughly where it would have been if it had grown at the 5 year moving average without the bubble and crash. Most of the biggest “bubble markets” are still beaten down pretty handily, and very few of the other factors contributing to the initial crash are around anymore- no one would characterize money or credit as “easy” these days, and the mortgage bundling / derivatives market is almost non-existent as compared to before. Something worth watching over the next few years, certainly, but a bubble “about to burst?” I think most likely not.

In this and other reports of a similar nature it is also noted that roughly 50%, or better, of the real estate transactions are in cash.

IMHO that would indicate that institutions and/or big money investors are placing their money where they can book a relatively quick return waiting for the stock market to take a serious dive. They pay cash for specific properties (some properties are recovering their values while others are not) and generate interest in the real estate market which brings in more investors and keeps the whirl wind going until the bubble pops. The early investors win and the later investors loose, similar to a Ponzi scheme. This will be a different kind of real estate crash but will have very similar effects. This bubble popping may also usher in the mini crash of the stock market (-25%±) that a lot of investors have been waiting for.

This is not the only bubble out there. Govt. Motors has entered in to a similar scam were they are taking all of there POS paper and bundling it and selling it to investor groups. They have set up a sham finance company that take the lowest scores walking in the door. Affordable cars to go in the affordable housing driveway.

Uncle Sam will be at the ready to bail them out too when it goes “poof” again.

“Systemic danger”, “deregulation”, and the rest will be rehashed to justify more wealth transfer to the associated crony’s via money printing.

“Capitalism” will also be blamed.

None of it matters, the sheep will be sheared and the parasites fed.

Another point to make is how the “insurance bubble” will be the pin to the next housing/commercial bubble. Think about the new flood insurance reverberations. The original flood insurance from the feds was in response to the insurance companies picking and choosing homes and ignoring all those in any flood zone. Any corporate clown understands “risk mitigation” winking. Think about this for a moment, any natural hurricane is 10, 20, 50 or 100 miles wide but do houses 100 miles inland have to have wind and hail insurance.? Nope. This restricts the number of houses in the pool and drives up rates. When a hundred mile hurricane comes barreling through all the way to Charlotte (Hugo) then everyone gets to crying over a lack of insurance coverage. What would housing payments be for all those homes if everyone had to have wind and hail all the way to at least Columbia. How would that decrease rates in Charleston or Myrtle Beach or Georgetown. The Idea of insurance is to have everyone pitch in to cover the losses of a few every once and a while. When politicians enact laws to exclude certain parties from paying in then the lobbyists step in for the kill. Buy low, sell Hi….

How do you handle the bubble in your brain vein bursting?

This path was certain when the fact that our economy is so dependent upon new housing construction became evident in the 2008 collapse. These companies are not flipping by the way. What has happened is that single family home ownership is now a corporate security (REIT). It was inevitable. The first-time home buyers of that era are underwater terribly. The only way out is default. So they stay put or walk and either way that neutralizes the mid-market home market (up and comers). The ones that follow are less inclined to purchase and when they do so they are mostly picking up the leftovers at bargains only to find that they have huge repair deals coming.

So, take American Homes 4 Rent for example. They are buying those homes in the market at slightly below or at market prices in the $165k-$229k range. They have representatives locking out local buyers at courthouse sales. They are packaging these homes and renting them. They are speading out across the country and it appears that they may be in trouble. So what is going to happen is that these homes will return to the market in worse shape than they were in originally and continue to erode comps and appraisals. The shareholders will be fleeced and probably at that time we will find out how much gov’t money was propping them up.

Now multiply that example by hundreds of such companies across the nation. Many readers will say yeah but they are building all around my area and somebody has to be buying these homes.

Correct, but if you look closely at the neighborhoods there are plenty examples of the above that are easy to overlook unless you study the public records and have access to MLS data.

As they say in Vegas, there is a sucker born every day. Personally, I laugh when I hear 50 year old couples that are soon to become empty-nesters talk about buying bigger and better homes. It is surprising how many people that “thought this could never happen here” are now saying they are “glad it is behind us”. IT’s a gov’t prop job of musical chairs and the music just stopped on us in 2008. The music has started again and it certainly will stop again. The only question is how soon.

In New York its a really weird thing because you can make 70k+ and live worse than poor people in SC.

Its the end of the USA as we knew it. Thanks to greed, corruption, and lawless rogues in our government. So whatcha going to do about it? Complain on website comment sections?

If you’re correct, why don’t you short some REITs? Or do you prefer to prognosticate without fear of economic consequence?

How do you know he hasn’t? How do you know we ALL haven’t? Better yet, why short Real Estate Investment Trusts? Wait for the market to drop and you can buy all the urban housing you can eat for the price of toilet paper.. or you can use money – same thing.

I love it when you talk finance. It shows how little the common man knows. I feel sorry for this country.

My house’s value has grown by at least 5% every year since 1987, when I bought it for 88k. It was prime real estate in a quiet part of downtown. This past year, its value doubled to 450k. In 2009-2010, it grew 1%. It has NEVER gone down. I live in Greenville, the home of the so-called “TEA Party crazies.” It’s GREAT to be from crazy-land!

Why do think things are so prosperous here? Because we “crazies” buy land the way you buy any commodity, but you can’t afford to be lay or ignorant about your purchase, and you have to hold it for as long as it takes. If you can’t afford to hold it, don’t buy it. And you should never, NEVER depend on the government to help you out, if you find you chose poorly.

Please feel free to lie and be as abusive as you feel you need, but when you are finished, it will still be great here, and you will still be wrong.