The dramatic recent events in Cyprus have highlighted the fundamental weakness in the European banking system and the extreme fragility of fractional reserve banking. Cypriot banks invested heavily in Greek sovereign debt, and last summer’s Greek debt restructuring resulted in losses equivalent to more than 25 percent of Cyprus’ GDP. These banks then took their bad investments to the government, demanding a bailout from an already beleaguered Cypriot treasury. The government of Cyprus then turned to the European Union (EU) for a bailout.

The terms insisted upon by the troika (European Commission, European Central Bank, International Monetary Fund) before funding the bailout were nothing short of highway robbery. While bank depositors have traditionally been protected in the event of bankruptcy or liquidation, the troika insisted that all bank depositors pay a tax of between 6.75 and 10 percent of their total deposits to help fund the bailout.

While one can sympathize with EU taxpayers not wanting to fund yet another bailout of a poorly-managed banking system, forcing the Cypriot people to pay for the foolish risks taken by their government and bankers is also criminal. In their desire to punish a “tax haven” catering supposedly to Russian oligarchs, the EU elites ensured that ordinary citizens would suffer just as much as foreign depositors. Imagine the reaction if in September 2008, the US government had financed its $700 billion bank bailout by directly looting American taxpayers’ bank accounts!

While the Cypriot parliament rejected that first proposal, they will have no say in the final proposal delivered by the EU and IMF: deposits over 100,000 euros are likely to see losses of at least 40 percent and possibly as much as 80 percent. “Temporary” capital controls that were supposed to last for days will now last at least a month and might remain in effect for years.

Especially affected have been the elderly, who were unable to use ATMs or to transfer money electronically. Despite the fact that ATMs severely limited the size of withdrawals during the two week-long bank closure, reports indicated that account holders who had access to Cypriot bank branches in London and Athens were able to withdraw most of their funds, leading to speculation that there would be no money available when banks finally opened up again. In other words, the supposed Russian oligarch money may well be already gone.

Remember that under a fractional reserve banking system only a small percentage of deposits is kept on hand for dispersal to depositors. The rest of the money is loaned out. Not only are many of the loans made by these banks going bad, but the reserve requirement in Euro-system countries is only one percent! If just one euro out of every hundred is withdrawn from banks, the bank reserves would be completely exhausted and the whole system would collapse. Is it any wonder, then, that the EU fears a major bank run and has shipped billions of euros to Cyprus?

The elites in the EU and IMF failed to learn their lesson from the popular backlash to these tax proposals, and have openly talked about using Cyprus as a template for future bank bailouts. This raises the prospect of raids on bank accounts, pension funds, and any investments the government can get its hands on. In other words, no one’s money is safe in any financial institution in Europe. Bank runs are now a certainty in future crises, as the people realize that they do not really own the money in their accounts. How long before bureaucrat and banker try that here?

Unfortunately, all of this is the predictable result of a fiat paper money system combined with fractional reserve banking. When governments and banks collude to monopolize the monetary system so that they can create money out of thin air, the result is a business cycle that wreaks havoc on the economy. Pyramiding more and more loans on top of a tiny base of money will create an economic house of cards just waiting to collapse. The situation in Cyprus should be both a lesson and a warning to the United States. We need to end the Federal Reserve, stay away from propping up the euro, and return to a sound monetary system.

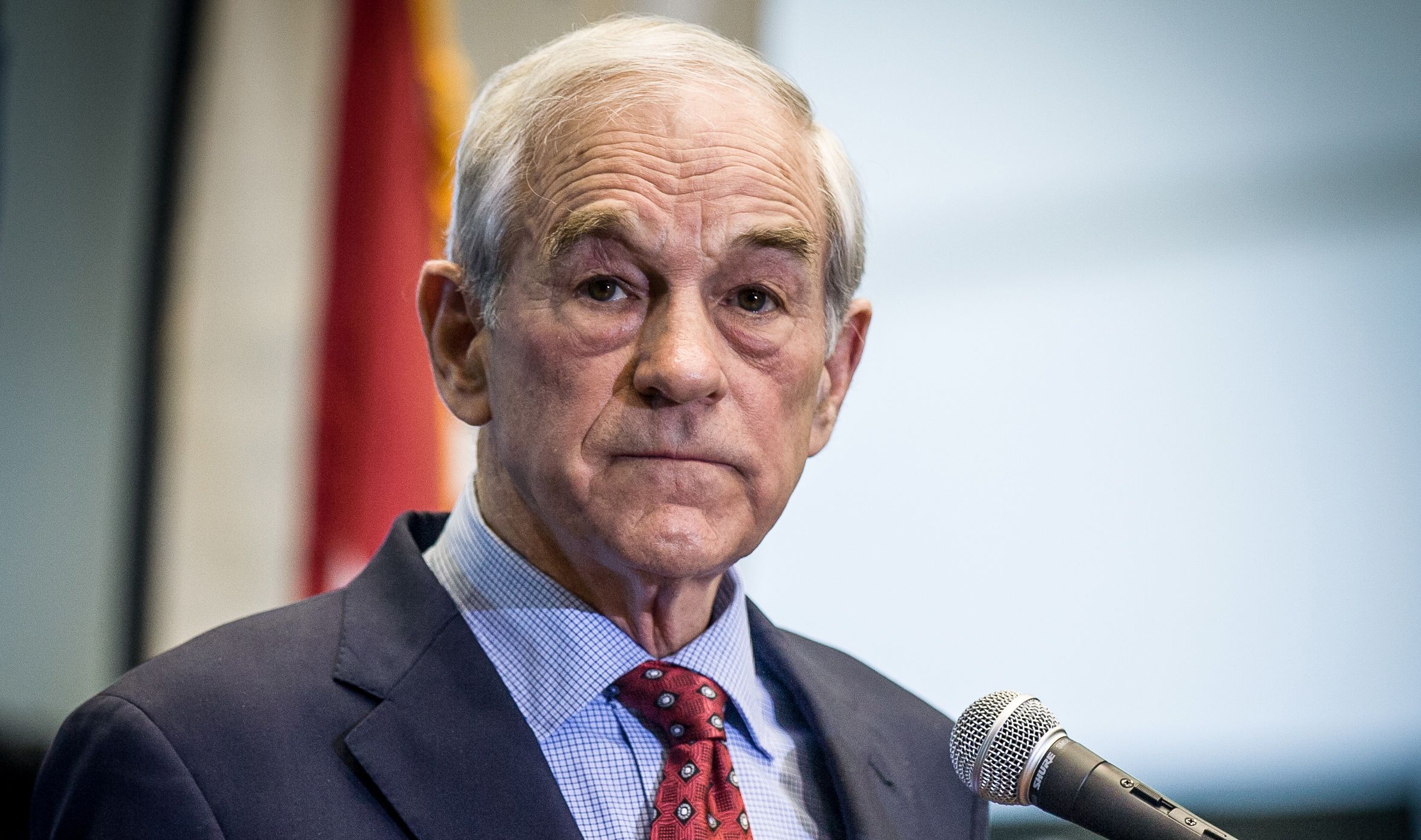

Ron Paul is a former U.S. Congressman from Texas, presidential candidate and leader of the pro-free market movement in the United States.

28 comments

Per Fritz Hollings, “We hear those in the national Congress running around and saying:

‘Whoopee, we might start a trade war; free trade, free trade, I am for

free trade,’ when they know free trade is like dry water. There is no

such thing.”

Per Fritz Hollings, “We hear those in the national Congress running around and saying:

‘Whoopee, we might start a trade war; free trade, free trade, I am for

free trade,’ when they know free trade is like dry water. There is no

such thing.”

Wow, you sound like Glenn Beck from 5 or more years ago or Ron Paul from 30 years ago. Too bad more people aren’t paying attention to those “crackpots.” Yeah, it can happen here too.

Wow, you sound like Glenn Beck from 5 or more years ago or Ron Paul from 30 years ago. Too bad more people aren’t paying attention to those “crackpots.” Yeah, it can happen here too.

It won’t happen here, we’re Americans, we know how to do it better here and we’re smarter. Just ask the socialist/fascists in DC, they’ll tell you all about it.

It won’t happen here, we’re Americans, we know how to do it better here and we’re smarter. Just ask the socialist/fascists in DC, they’ll tell you all about it.

Here’s a hint: Don’t bail out the fucking banks.

Here’s a hint: Don’t bail out the fucking banks.

END THE FED!

END THE FED!

I’m Ron Paul and gynecology has taught me all I need to know about economics

The economy is like a vagina, occasionally it gets fucked by a bunch of random dicks?

I can only hope you have a lot of US dollars stored in your account with some US bank. And, one fine day, you wake up – and see that 20% of your account was taken by the US Federal govt – not because you were late on child-support or failed to pay spousal-support or because you cheated the IRS on your taxes – but because (in spite of paying every thing on-time & paying it honestly) there were some bureaucrats that were too greedy or lethargic and they let your hard-worked earnings to be taken away to pay off debts. Debts that were created to fund wars – wars that involved your own family members to either die or loose-a-limb in some remote Mid-Eastern desert.

.

I’ll stick around to see how you feel then. Just like I’m seeing how Cypriot citizens are feeling now – helpless, at the mercy of various BIG entities (ECB, IMF, World Bank, etc), dejected, cheated. If you choose to not put yourself in their shoes at this time (& make amends) – FUTURE will forcibly put you there.

.

MN

“In the absence of the gold standard, there is no way to protect savings from

confiscation through inflation. … This is the shabby secret of the welfare

statists’ tirades against gold. Deficit spending is simply a scheme for the

confiscation of wealth. Gold stands in the way of this insidious process. It

stands as a protector of property rights. If one grasps this, one has no

difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan

Greenspan

YA you smell Like a count mouth

I’m Ron Paul and gynecology has taught me all I need to know about economics

The economy is like a vagina, occasionally it gets fucked by a bunch of random dicks?

I can only hope you have a lot of US dollars stored in your account with some US bank. And, one fine day, you wake up – and see that 20% of your account was taken by the US Federal govt – not because you were late on child-support or failed to pay spousal-support or because you cheated the IRS on your taxes – but because (in spite of paying every thing on-time & paying it honestly) there were some bureaucrats that were too greedy or lethargic and they let your hard-worked earnings to be taken away to pay off debts. Debts that were created to fund wars – wars that involved your own family members to either die or loose-a-limb in some remote Mid-Eastern desert.

.

I’ll stick around to see how you feel then. Just like I’m seeing how Cypriot citizens are feeling now – helpless, at the mercy of various BIG entities (ECB, IMF, World Bank, etc), dejected, cheated. If you choose to not put yourself in their shoes at this time (& make amends) – FUTURE will forcibly put you there.

.

MN

“In the absence of the gold standard, there is no way to protect savings from

confiscation through inflation. … This is the shabby secret of the welfare

statists’ tirades against gold. Deficit spending is simply a scheme for the

confiscation of wealth. Gold stands in the way of this insidious process. It

stands as a protector of property rights. If one grasps this, one has no

difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan

Greenspan

YA you smell Like a count mouth

Jesus! Some of ya’ll little guys could probably do a gang-bang in his forehead…,just don’t get carried away,and fuck his eyeballs out…

Jesus! Some of ya’ll little guys could probably do a gang-bang in his forehead…,just don’t get carried away,and fuck his eyeballs out…

your system aint working DUmb fuck inhuman Bankster GO AWAY ! LOSERS !

your system aint working DUmb fuck inhuman Bankster GO AWAY ! LOSERS !

Isn’t inflating the currency doing the same thing as simply stealing money directly out of the account?

Isn’t inflating the currency doing the same thing as simply stealing money directly out of the account?

GAWD the people on this site are a bunch of freaks (Mostly)

191 posts on reality TV stars Raviolli or whatever the hell the libtards name is and 13 on Ron Paul.

Disgusting.

GAWD the people on this site are a bunch of freaks (Mostly)

191 posts on reality TV stars Raviolli or whatever the hell the libtards name is and 13 on Ron Paul.

Disgusting.